The Internal Revenue Service on Tuesday announced roughly $1 billion in penalty relief to those owing back taxes from 2020 and 2021, during the height of the COVID-19 pandemic.

Read MoreTag: taxes

As Joe Biden Promised Tax Fairness, His Son Rushed to Erase His Delinquent Taxes, IRS Memos Show

As Joe Biden marched toward the presidency in 2020 with a promise to force the wealthy to pay their “fair share” of taxes, his son Hunter was scrambling behind closed doors to clean up a trail of his own delinquent taxes before they became an election scandal, according to once-secret IRS memos made public recently by Congress.

IRS agents would soon discover that the future first son was continuing to allegedly misrepresent his income and deductions to the very accountant he had hired to help, the memos show.

Read MoreCommentary: The New Right Cares About More than Taxes

New research is challenging assumptions about the Republican Party’s core values, showing the GOP of the 2020s is an entirely different animal from the GOP of the 2010s. The research captures an increasing shift toward populism and America First priorities that has been growing since Former President Trump’s election in 2016.

The study by American Compass divides Republicans into two camps, the Old Right and the New Right, based on their economic priorities and approach to cultural issues.

Read MoreCommentary: Tax Relief Is Coming to Millions of Red-State Residents in Ohio, Connecticut, and More

July marked the beginning of Fiscal Year 2024 for 46 of the 50 states. It also closes the books on most state legislative sessions in what was an incredible 2023 for hard-working taxpayers.

In recent years, we’ve seen significant income tax relief in the states. Notably, 10 states – Kentucky, West Virginia, Montana, Utah, Arkansas, North Dakota, Indiana, Nebraska, Connecticut, and Ohio – have cut personal income taxes (PIT) in 2023. With the new addition of West Virginia, North Dakota, and Connecticut, 22 states have cut personal income taxes since 2021, with several of these states cutting taxes multiple times during that period.

Read MorePoll: Taxes, Cost of Living Driving Away Young Pennsylvania Residents

A new survey suggests the price residents pay to live in Pennsylvania tempts younger generations to move.

Results from the Commonwealth Foundation poll conducted last month show more than half of respondents between the ages of 18 and 44 have considered moving to another state – or know someone who wants to do the same.

Read MoreCommentary: The Surprising Origins of the ‘No Taxation Without Representation’ Slogan

Ask most Americans where the slogan “No taxation without representation!” came from and the likely response will be “American colonists protesting against Britain in the 1760s.” But the spirit, if not the precise letter of the phrase, originated more than a century before. Moreover, we can thank the Brits themselves for it. It started with something called the “ship tax.”

Since the early Middle Ages, English custom allowed the monarch to impose a special levy in times of war upon citizens who lived in coastal settlements. They could meet the requirement by providing ships, shipbuilding materials, or money for the Crown to build ships (hence the name, “ship tax”). Kings and Queens levied the “tax” as a royal prerogative, meaning they skipped the annoyance of securing the consent of Parliament as required in the Magna Carta of 1215.

Read MoreCommentary: The Bidens’ Existential Threats to the American Rule of Law

President Joe Biden, the Biden grifting conglomerate, the Department of Justice, and the FBI under its fourth consecutive weaponized director, are in danger of subverting the American system of law.

They are in various ways undermining the tradition of self-reported income tax computation and voluntary compliance.

Read MoreIRS Whistleblower: Hunter Biden Hasn’t Paid Taxes on 2014 Money from Ukrainian Oligarch’s Firm

Federal agents secured evidence that Hunter Biden engaged in a “pretty classic tax evasion scheme” that allowed him to avoid paying taxes on millions of dollars in income since at least 2014, and the deal he ultimately got would not have been afforded to other Americans facing such serious charges, an IRS whistleblower who supervised the investigation tells Just the News.

“If these facts were from the local businessman or the neighbor next door, they would have been charged, they would have already probably had their entire sentence,” IRS Supervisor Agent Gary Shapley said during a 45-minute interview aired Thursday on the John Solomon Reports podcast.

Read MoreFeds Built Case Hunter Biden Evaded $2.2 Million in Taxes Dating to 2014 Before Being Thwarted

If Hunter Biden pleads guilty next month as expected to two misdemeanor tax evasion charges, he’ll be admitting he shorted the U.S. government of about $100,000 in taxes he owed in 2017-18.

But it’s a far cry from the evidence the IRS and FBI developed showing a pattern of tax evasion and avoidance that stretched back to his father’s term as vice president a decade ago, according to newly released documents and testimony.

Read MoreRamaswamy: Plea Deal Keeping Hunter Biden out of Prison Is a ‘Joke,’ the ‘Perfect Fig Leaf’

GOP presidential candidate Vivek Ramaswamy is blasting a plea deal announced Tuesday that will keep President Joe Biden’s troubled son out of prison on two federal misdemeanor counts of failing to pay his taxes and a separate felony charge of possession of a firearm by a known drug user.

Read MoreProperty Taxes Climb 3.6 Percent Across U.S. to $339.8 Billion

Property taxes levied on single-family homes in the United States increased 3.6 percent to $339.8 billion in 2022, according to a new report from a real estate data firm.

That’s up from $328 billion in 2021. The 2022 increase was more than double the 1.6 percent growth in 2021, but smaller than the 5.4 percent increase in 2020, according to the report from ATTOM, a property data provider.

Read MorePoll: 73 Percent of Taxpayers Say Government Doesn’t Use Their Taxes Wisely

Ahead of Tax Day on April 18, 73% of taxpayers said the government doesn’t use their taxes wisely, a new survey found. A separate report found that red states have the better taxpayer return on investment.

Wallethub’s “Taxpayer Survey” found that 28% of respondents said charities would better spend their money; 26% said local governments would best spend their money, followed by state government (22%), the federal government (16%) and religious groups (13%).

Read MoreCommentary: States Raising Taxes on the Rich Should Expect a Line at the Exit

It’s an old aphorism that if you tax something, you get less of it. Seven states are at risk of finding out exactly how that truism applies to wealth tax legislation introduced in each should their proposed taxes become law.

Read More13 States May Tax Canceled Student Loans

Borrowers in thirteen states who have student debt canceled under the Biden administration’s plan may still be taxed hundreds of dollars next year on their forgiven loans.

Read MoreCommentary: Long-Term Study Finds That Higher Corporate and Personal Taxes Lower Real GDP

by Ross Pomeroy One of the main planks of President Biden and congressional Democrats’ agenda is making corporations and high-earning Americans “pay their fair share” through higher taxes. But a recently published analysis in the journal SAGE Open delving into sixty years of U.S. economic data from 1960 to 2020 suggests that their…

Read MoreTrump: ‘America Is on the Edge of an Abyss’

Donald Trump on Saturday delivered stinging rebukes of the Biden administration at the Dallas Conservative Political Action Conference, one of a continuing series of indications that the still-popular former president has set his sights on a return to the White House for 2024.

Trump during his speech declared that the U.S. “is being destroyed more from the inside than the out,” and that the country “is on the edge of an abyss, and our movement is the only force on earth that can save it.”

Read MoreCommentary: Yes, Taxes Can Drive People to Move

Many people will tell that people choose to live somewhere based on factors like the weather or proximity to family, and that taxes don’t enter into the equation. While there is a lot of truth to that understanding, when taxes reach a certain point, they can cause people to alter their behavior. Have you heard of voting with your feet? Here’s how that exact concept is playing out for two Iowa families.

Read MorePhiladelphia Voters Want Lower Property Taxes, but Higher Taxes on the Rich

Philadelphia has one of the worst city tax burdens in America, and voters aren’t pleased. It will also be a struggle for city leaders to find a politically popular solution.

A poll from the Pew Charitable Trusts found that Philadelphians have become more opposed to taxes, but an anti-tax revolt isn’t brewing in the city either.

Read MoreIRS Warns Taxpayers of Potential Scams in New ‘Dirty Dozen’ List

The Internal Revenue Service is warning taxpayers of several tax scams.

The scams cover four transactions involving charitable remainder annuity trusts, Maltese individual retirement arrangements, foreign captive insurance, and monetized installment sales.

Read MoreSurprise Home Reassessments Create a Tax Burden in Pennsylvania for New Owners

Spot assessments can be used across Pennsylvania to reassess a property’s value, resulting in higher tax bills for homeowners. According to a new report, Allegheny County’s school districts have driven an increase in spot appeals, increasing assessed values by almost $462 million.

The result is that homeowners must pay more in taxes, incentivizing school districts to request a spot assessment.

Read MoreCommentary: The Tax Increase That’s Hidden in Plain Sight

Americans have less money than they had last year — though taxes haven’t been raised. So what’s the problem? Inflation, which has increased at a 40-year high annual pace of 7.9%. It acts as a hidden tax because we don’t see it listed on our tax bills, but we sure see less money on our bank accounts.

In fact, inflation-adjusted average hourly earnings for private employees are down about 2.5% over the last year. This means a person with $31.60 in earnings per hour is buying 2.5% less of a grocery basket purchased just last year. “For a typical family, the inflation tax means a loss in real income of more than $1,900 per year,” stated Joel Griffin, a research fellow at The Heritage Foundation.

Read MoreBiden Unveils $5.8 Trillion Budget Proposal with Increased Taxes on Businesses, Wealthy Individuals

President Joe Biden unveiled a new 2023 budget proposal Monday along with major tax increases to help pay for it.

Biden’s budget, which comes in at about $5.8 trillion, is not expected to become law, but presidential budgets help set the legislative priorities for the year to come.

Read MoreWith Gas Prices at Historic Highs, Biden Calls for Raising Taxes on Oil Drillers

President Joe Biden’s budget proposes to scrap more than $45 billion in fossil fuel subsidies, his administration’s latest attack on the beleaguered industry.

The White House budget will remove more than a dozen fossil fuel industry tax credits, increasing the federal government’s revenue by an estimated $45.2 billion between 2023-2032, according to the proposal published Monday. The administration explained that the proposal was written to prevent further fossil fuel investment.

Read MoreCommentary: The IRS Can’t Get the Basics Right, So Don’t Add to Its Authority

All taxpayers are dealing with a disastrous filing season this year, with the IRS backed up on processing millions of returns and refunds from last year and communication from the agency nonexistent at best. But some taxpayers will have an added headache in the future as a result of an unnecessary new paperwork requirement that went into effect this year. Fortunately, however, legislation introduced by Sen. Bill Hagerty (R-TN) would address this issue by removing the burdensome new requirement.

Ever since IRS Commissioner Chuck Rettig claimed last year that the “tax gap,” or the gap between what the IRS collects and what it believes it is owed, could be as large as $1 trillion, politicians and legislators have been scrambling to propose ways to collect all that missing revenue. That’s despite the fact that more sober analyses show that the $1 trillion figure is probably wildly exaggerated, that it is functionally impossible to wholly prevent tax evasion, and that a far greater concern is the IRS’s inability to handle its taxpayer service responsibilities.

But as far as proposals to collect all this supposed “extra revenue” go, most of the focus has rightly been on schemes to drastically increase the IRS’s enforcement budget and allow the IRS to snoop on taxpayers’ financial accounts. But another more targeted change has already gone into effect, and is already causing problems.

Read MoreIRS Reverses Plans for Facial Recognition Software on Its Website

On Monday, the Internal Revenue Service (IRS) announced in a statement that it would no longer be moving forward with previous plans to implement a controversial facial recognition software on its website in order for users to access certain tax records.

According to CNN, the IRS’s reversal came after widespread backlash by elected officials, privacy groups, and others who pointed out that such technology would constitute a massive overreach and violation of individual privacy. The IRS said in its statement that it would “transition away from using a third-party verification service involving facial recognition,” and would instead add an “additional authentication process.” The agency also vowed to “protect taxpayer data and ensure broad access to online tools.”

“The IRS takes taxpayer privacy and security seriously,” IRS commissioner Chuck Rettig said, “and we understand the concerns that have been raised. Everyone should feel comfortable with how their personal information is secured, and we are quickly pursuing short-term options that do not involve facial recognition.”

Read MoreNew Report: Pennsylvania’s Government Spending Damaging Economy

A report released this week by the Commonwealth Foundation (CF), a Harrisburg-based think tank, underscores the drawbacks of lavish government spending for ordinary Pennsylvanians.

Inflation and the economic policies that fuel it have already weighed on the minds of Americans for months. Federal spending during the COVID-19 pandemic has skyrocketed to create a debt nearing $30 trillion, equating to 133 percent of the U.S. gross domestic product and amounting to $239,000 per taxpayer.

Read MoreCommentary: The GOP Can Reclaim the Child Tax Credit – And Use it to Win in 2022

As part of his Contract with America, House Speaker (and my former boss) Newt Gingrich helped first introduce the Child Tax Credit (CTC), passing it in 1997. Originally the idea of President Ronald Reagan, the CTC was founded on the conservative principles that raising children is God’s work, and parents should not be punished or held back for choosing family in a country that is always moving forward. President Trump continued this tradition by doubling the CTC in 2017. As Speaker Gingrich said during a 1995 speech, “We believe that parents ought to have the first claim on money to take care of their children rather than bureaucrats.”

Democrats reformed the CTC in 2021, as part of their wildly overdone American Rescue Plan. They’ve sought to continue their changes to the CTC in the even-more-overdone Build Back Better Act (BBB), a hulking Frankenstein of bad Democratic ideas. But the new version of the CTC may be an exception. It continues fulfilling Speaker Gingrich’s contract, empowering families to work and earn, and to raise their children with their own values. The spirit and core of that policy is even better reflected by flat, poverty-busting monthly disbursement of the credit. It’s the only salvageable ship in the sinking BBB fleet.

The CTC – in its 2021 form – does not stray too far from the $500-per-child tax cut that was initially passed in 1997. The payments, which provided eligible families with up to $300 per month for each qualifying child under age 6 and up to $250 per month for each qualifying child aged 6 to 17, stimulated regional economies, protected families from rising costs, provided direct cash relief, and removed bureaucratic hurdles.

Read MoreCommentary: We Can’t Split the Difference on Culture

The United States is an outlier among established democracies in two respects: We face both falling social trust and rising polarization. I have argued that the two dynamics connect in a doom loop. Trust in others and institutions falls, leading to greater polarization, which drives trust down even more. That is why the two processes are getting worse at the same time. A nasty dynamic has taken hold in the country, and it regularly affects all of us.

Many issues polarize us, but we should prefer polarization on economics to polarization on culture. Polarization is least damaging on issues most amenable to “splitting the difference”—as many economic issues are.

Consider taxes. Progressives want higher taxes on the rich, while conservatives want lower taxes. The possibility of compromise always exists—and even if it is obscured beneath the surface of our political tempers, uncovering it is not hard. For example, we could average our preferred tax rates, and no one would come away emptyhanded. Granted, that’s not how we have handled this issue in the past, but it’s at least conceivable.

Read MoreKansas Lawmakers Reveal Draft Bill to Eliminate the Food Tax

Kansas Gov. Laura Kelly and the Legislature’s Democratic leadership on Thursday released a draft bill to get rid of the food sales tax in the state.

Known colloquially as the “Axe the Food Tax” bill, the legislation would eliminate the state’s 6.5% sales tax on food. The draft bill also includes a full exemption on state and local taxes for items bought at farmers markets.

Senate Minority Leader Dinah Sykes, D-Lenexa, and House Minority Leader Tom Sawyer, D-Wichita, helped craft the legislation and are formally looking for co-sponsors.

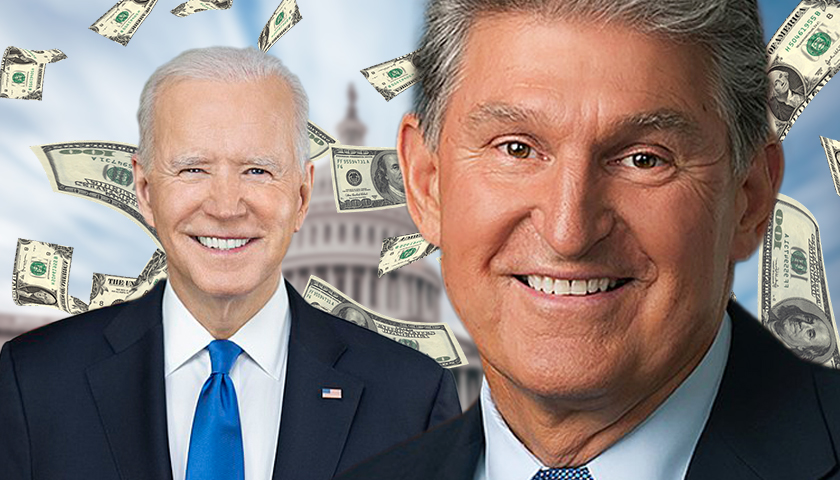

Read MoreManchin Reportedly Told the White House He Supports a Billionaire Tax

West Virginia Democratic Sen. Joe Manchin told the White House last week that he was willing to endorse some type of billionaire tax in President Joe Biden’s domestic spending package before coming out against it days later, The Washington Post reported.

Manchin said that a tax on billionaires’ wealth could be a means to pay for the package, according to the Post, citing three people familiar with his offer to the White House. The outlet reported that it was unclear whether Manchin provided an estimate of how much money the provision would raise.

Programs in Manchin’s $1.8 trillion counteroffer included universal pre-K for ten years, expansions to the Affordable Care Act and billions of dollars for climate change mitigation measures, according to the Post, but it did not include the child tax credit, which many Democrats have touted as one of the single biggest policy achievements of the year.

Read MoreCommentary: When Envy Trumps Economics

President Joe Biden has seized on a winning message: tax the rich. He tweets incessantly, “Big corporations and the super wealthy have to start paying their fair share of taxes. It’s long overdue,” and claims his Build Back Better agenda “will be paid for by the wealthy paying their fair share.”

Instead of highlighting the few benefits of his Build Back Better Act, (H.R. 5376) his public positioning is about harming a particular group. Why? This message sells with three key constituencies he’s counting on to pressure Congress to vote yes.

Younger millennials and Gen Z who believe the uber-rich should not exist.

The working rich who believe taxing themselves is a solution to poverty and a source of economic growth.

The governing elites who want to accumulate more government control by enlarging the dependent class.

Younger Millennials and Gen Z: Being Rich Is Inherently Bad

A recent PEW research poll revealed that half of adults under 30 believe billionaires are bad for the U.S. One self-proclaimed “anticapitalist” Millennial and trust fund beneficiary summed it up this way: “I want to build a world where someone like me, a young person who controls tens of millions of dollars, is impossible.” Accordingly, wealth comes from exploitation. Giving their money away (or giving it to Washington to redistribute into a social justice plan) is making “reparations.”

Using this logic, the late Steve Jobs should have been prohibited from earning ridiculous amounts of wealth. Because of his ingenuity, however, millions of jobs have been created, young people have been inspired, and some of the greatest technology has been made available. Like Jobs, those who earn their billions through innovation (and experience many failures in their pursuit and on their own dime) reinvest it in the economy in ways the government could not. Moreover, their earnings are a result of what others were willing to pay them.

Working Rich: We’re Moral People

A 2019 letter penned by more than a dozen of the wealthiest Americans — including George Soros, heiress Abigail Disney, and Molly Munger, daughter of Berkshire Hathaway Vice Chairman Charlie Munger— stated, “it is our duty to step up and support a wealth tax that taxes us.” They believe America “has a moral, ethical and economic responsibility to tax our wealth more.” Mr. Biden’s allies on the Left share this opinion.

A “transfer of wealth” by taxing the rich is nothing short of legal theft. Government is not, and cannot be, altruistic. Government has nothing to give that it has not taken from another by force. With few exceptions, this type of help will erode self-reliance and the moral incentive of charitable action, leading to more government spending.

Ignored is that the free market has done more to break the cycle of poverty than any government program, as it empowers people and mends the nonfinancial, relational parts of society.

The wealthy could put their money to better use by directly donating to effective charitable causes, investing in local communities, or investing in expanding their businesses to serve more consumers and create more jobs. Moreover, there is nothing stopping billionaires from giving their wealth directly to the U.S. government. If they genuinely believe it is their “moral, ethical and economic responsibility,” there is no need to wait.

Governing Elites: We Like Being In Control

They say it’s about social or economic justice, but President Biden’s messaging is déjà vu from Obama-era calls to redistribute wealth, or Marxist accolades of redistribution as a form of economic justice. The increasing popularity of taxing the rich makes the job of government elites easier. President Biden even engages in shame-tweeting such as, “Those at the top have been getting a free ride at the expense of the middle class for far too long.” But the bureaucrats’ real reason to tax the rich is to snatch individuals’ birthrights of personal responsibility, a move toward a centralized system that deflates personal choices and violates personal rights.

Taken together, these ideas unfortunately resonate beyond younger millennials and Gen Z, the working rich, and the governing elites. Jumping onto the “tax the rich” bandwagon feels good because – why should the rich have that much money anyway?

Envy permeates this ideology. Yet economics trumps envy.

The actual tax burden will not fall on folks writing checks to the US Treasury. The rich will, for the most part, still be rich. It’s the middle- and working class who will pay dearly when high-income individuals respond to the tax hike by simply investing less, resulting in fewer job opportunities and lower wages.

Left to fend for their economic lives will be small-business owners. President Biden may consider them wealthy, but taxing these individuals more will decimate communities, as jobs are lost or not created, and wages and hours are cut.

There’s no question that taxing the rich is popular. Problem is, it’s also reckless.

Instead of highlighting the few benefits of his Build Back Better Act, (H.R. 5376) his public positioning is about harming a particular group. Why? This message sells with three key constituencies he’s counting on to pressure Congress to vote yes.

Younger millennials and Gen Z who believe the uber-rich should not exist.

The working rich who believe taxing themselves is a solution to poverty and a source of economic growth.

The governing elites who want to accumulate more government control by enlarging the dependent class.

Commentary: When Envy Trumps Economics

President Joe Biden has seized on a winning message: tax the rich. He tweets incessantly, “Big corporations and the super wealthy have to start paying their fair share of taxes. It’s long overdue,” and claims his Build Back Better agenda “will be paid for by the wealthy paying their fair share.”

Instead of highlighting the few benefits of his Build Back Better Act, (H.R. 5376) his public positioning is about harming a particular group. Why? This message sells with three key constituencies he’s counting on to pressure Congress to vote yes.

Younger millennials and Gen Z who believe the uber-rich should not exist.

The working rich who believe taxing themselves is a solution to poverty and a source of economic growth.

The governing elites who want to accumulate more government control by enlarging the dependent class.

Younger Millennials and Gen Z: Being Rich Is Inherently Bad

A recent PEW research poll revealed that half of adults under 30 believe billionaires are bad for the U.S. One self-proclaimed “anticapitalist” Millennial and trust fund beneficiary summed it up this way: “I want to build a world where someone like me, a young person who controls tens of millions of dollars, is impossible.” Accordingly, wealth comes from exploitation. Giving their money away (or giving it to Washington to redistribute into a social justice plan) is making “reparations.”

Using this logic, the late Steve Jobs should have been prohibited from earning ridiculous amounts of wealth. Because of his ingenuity, however, millions of jobs have been created, young people have been inspired, and some of the greatest technology has been made available. Like Jobs, those who earn their billions through innovation (and experience many failures in their pursuit and on their own dime) reinvest it in the economy in ways the government could not. Moreover, their earnings are a result of what others were willing to pay them.

Working Rich: We’re Moral People

A 2019 letter penned by more than a dozen of the wealthiest Americans — including George Soros, heiress Abigail Disney, and Molly Munger, daughter of Berkshire Hathaway Vice Chairman Charlie Munger— stated, “it is our duty to step up and support a wealth tax that taxes us.” They believe America “has a moral, ethical and economic responsibility to tax our wealth more.” Mr. Biden’s allies on the Left share this opinion.

A “transfer of wealth” by taxing the rich is nothing short of legal theft. Government is not, and cannot be, altruistic. Government has nothing to give that it has not taken from another by force. With few exceptions, this type of help will erode self-reliance and the moral incentive of charitable action, leading to more government spending.

Ignored is that the free market has done more to break the cycle of poverty than any government program, as it empowers people and mends the nonfinancial, relational parts of society.

The wealthy could put their money to better use by directly donating to effective charitable causes, investing in local communities, or investing in expanding their businesses to serve more consumers and create more jobs. Moreover, there is nothing stopping billionaires from giving their wealth directly to the U.S. government. If they genuinely believe it is their “moral, ethical and economic responsibility,” there is no need to wait.

Governing Elites: We Like Being In Control

They say it’s about social or economic justice, but President Biden’s messaging is déjà vu from Obama-era calls to redistribute wealth, or Marxist accolades of redistribution as a form of economic justice. The increasing popularity of taxing the rich makes the job of government elites easier. President Biden even engages in shame-tweeting such as, “Those at the top have been getting a free ride at the expense of the middle class for far too long.” But the bureaucrats’ real reason to tax the rich is to snatch individuals’ birthrights of personal responsibility, a move toward a centralized system that deflates personal choices and violates personal rights.

Taken together, these ideas unfortunately resonate beyond younger millennials and Gen Z, the working rich, and the governing elites. Jumping onto the “tax the rich” bandwagon feels good because – why should the rich have that much money anyway?

Envy permeates this ideology. Yet economics trumps envy.

The actual tax burden will not fall on folks writing checks to the US Treasury. The rich will, for the most part, still be rich. It’s the middle- and working class who will pay dearly when high-income individuals respond to the tax hike by simply investing less, resulting in fewer job opportunities and lower wages.

Left to fend for their economic lives will be small-business owners. President Biden may consider them wealthy, but taxing these individuals more will decimate communities, as jobs are lost or not created, and wages and hours are cut.

There’s no question that taxing the rich is popular. Problem is, it’s also reckless.

Instead of highlighting the few benefits of his Build Back Better Act, (H.R. 5376) his public positioning is about harming a particular group. Why? This message sells with three key constituencies he’s counting on to pressure Congress to vote yes.

Younger millennials and Gen Z who believe the uber-rich should not exist.

The working rich who believe taxing themselves is a solution to poverty and a source of economic growth.

The governing elites who want to accumulate more government control by enlarging the dependent class.

Newt Gingrich Commentary: Abolish the Georgia State Income Tax

The time has come to abolish the Georgia state income tax.

Sen. David Perdue was exactly right in proposing to eliminate the state income tax. He was also right in suggesting that he could work with the Georgia state legislature and find ways to return money to the people of Georgia rather than focusing it on the state bureaucracies.

The money is clearly there. The Atlanta Journal Constitution reported, “Despite pandemic, Georgia ends fiscal year with a record $3.2 billion jump in revenue.” The article went on to note, “The state saw revenue grow 13.5% over 2020. … Besides the boon in state tax collections, Georgia is also receiving about $4.7 billion or so from the latest federal COVID-19 relief plan.”

Read MoreCommentary: Youngkin Shock Win in Virginia Vote of No Confidence in Biden, Portends Red Wave for GOP in Congress in 2022

This is one of the greatest votes of no confidence in the 21st Century.

Against the destructive policies of President Joe Biden, a torrent of spending that has brought back memories of the 1970s — surging inflation as the middle class are taxed their savings at the grocery store and then scenes of American defeat overseas in Afghanistan that stranded hundreds of Americans and thousands of American allies, who now suffer under the tyranny of the Taliban.

Read MoreCommentary: Taking the Infrastructure Bill Hostage Didn’t Work

Back in August, New York magazine’s Jonathan Chait blessed the strategy of the Congressional Progressive Caucus to withhold their votes for the Senate’s bipartisan physical infrastructure plan until that bill was effectively linked to a bigger, broader, and surely partisan, measure investing in a range of items from climate protection to universal preschool. He argued that “ransoming the infrastructure bill” would turn the tables on the party’s moderates:

Historically, most partisan bills are shaped by the preferences of the members of Congress closest to the middle, and their colleagues on the political extreme simply have to go along with it. … This time, the left has real power. Progressives can credibly threaten to sink a priority that moderates care about more than they do.

Twice in the past two months, most recently last Thursday, the House progressives successfully executed this strategy, blocking attempts by Speaker Nancy Pelosi to pass the bipartisan infrastructure legislation before an agreement is reached on the larger “Build Back Better” bill.

Read More