A state lawmaker is urging colleagues to support a bill he is drafting to legalize esports betting in Pennsylvania. Representative Ed Neilson (D-Philadelphia) began circulating a memorandum last week making the case for legitimating video-game betting in the Keystone State, observing that the esports business took in $1.1 billion worldwide in 2022 and is predicted to soon realize a $1.8-billion global value.

Read MoreTag: Ed Rendell

State Representative Pushes to Constitutionally Eliminate Pennsylvania School Property Taxes

State Representative Frank Ryan (R-PA-Palmyra) this week proposed amending the Pennsylvania Constitution to eliminate the portion of property taxes collected by localities to fund public schools.

In February, Ryan sponsored another bill to abolish school property taxes by statute; that measure has yet to receive a vote in the House of Representatives Finance Committee. While enacting a statute requires majority assent of the House and Senate and the signature of the governor, amending the state Constitution requires House and Senate approval in two consecutive sessions. The policy would then go before Pennsylvania voters as a ballot question for approval or rejection and the governor would play no role in that process.

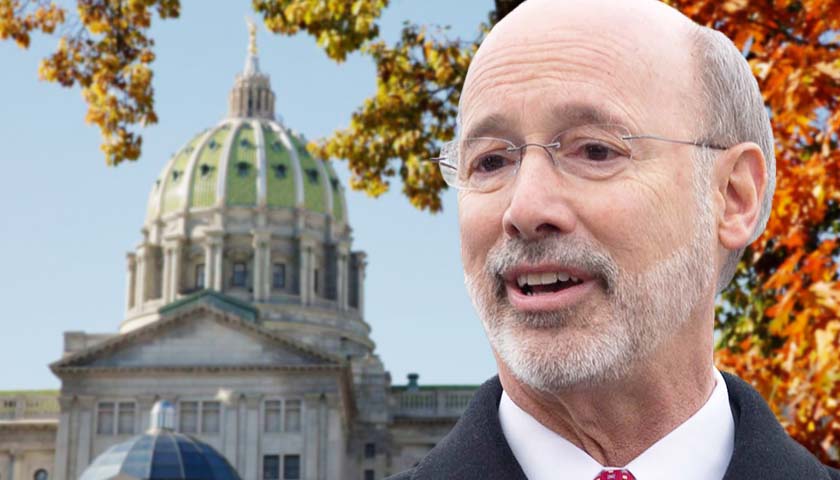

Read MorePennsylvania Governor and Business Leaders Celebrate Corporate Tax Reduction

Pennsylvania business advocates joined Governor Tom Wolf (D) at the York County Economic Alliance on Monday to welcome an upcoming change in tax policy championed by entrepreneurs across the commonwealth.

Via the new budget agreed to this summer by Wolf and the Republican-controlled General Assembly, Pennsylvania will begin a decade-long phased halving of its corporate net income tax (CNIT). Of the forty-four states with a business income tax, the size of the Keystone State’s current 9.99-percent rate is second only to New Jersey’s 11.5-percent tax. Besides these two states, only four others levy top business income tax rates that exceed nine percent.

Read More