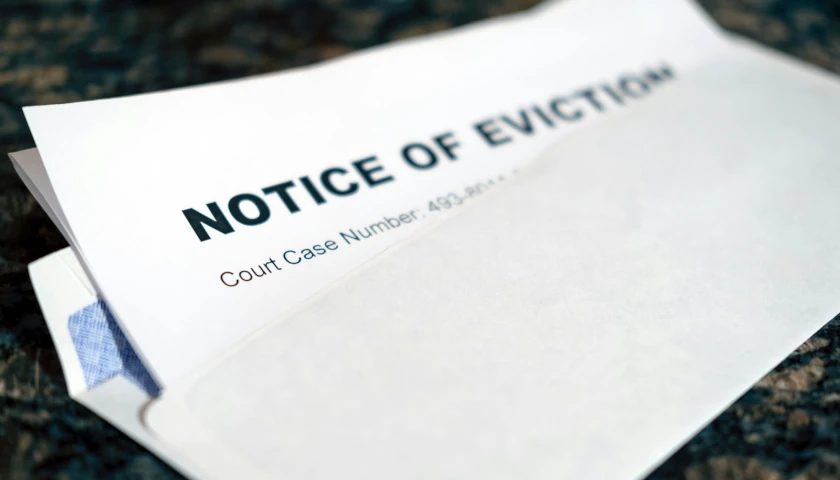

The federal government overestimated the number of jobs in the U.S. economy by 818,000 between April 2023 and March 2024, according to data from the Bureau of Labor Statistics released Wednesday, stoking fears of a slowdown in the U.S. economy.

Economists at Goldman Sachs (GS) and Wells Fargo anticipated the government had overestimated job growth by at least 600,000 in that span, while economists at JPMorgan Chase had predicted a lesser decline of 360,000, according to Bloomberg. The downward revision follows a trend of the BLS overestimating the number of nonfarm payroll jobs added, with the cumulative number of new jobs reported in 2023 roughly 1.3 million less than previously thought as of February 2024.

Read More