Fueled by massive federal subsidies in the Inflation Reduction Act (IRA), solar developers are looking to the wide open spaces of rural lands as the best places to site their projects. This is also where much of America’s farm and range land is located, as well as communities that like the existing look and character of their neighborhoods.

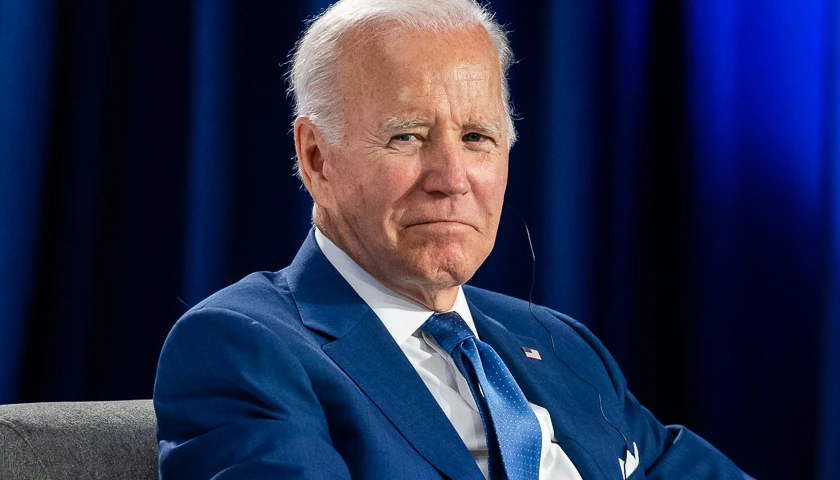

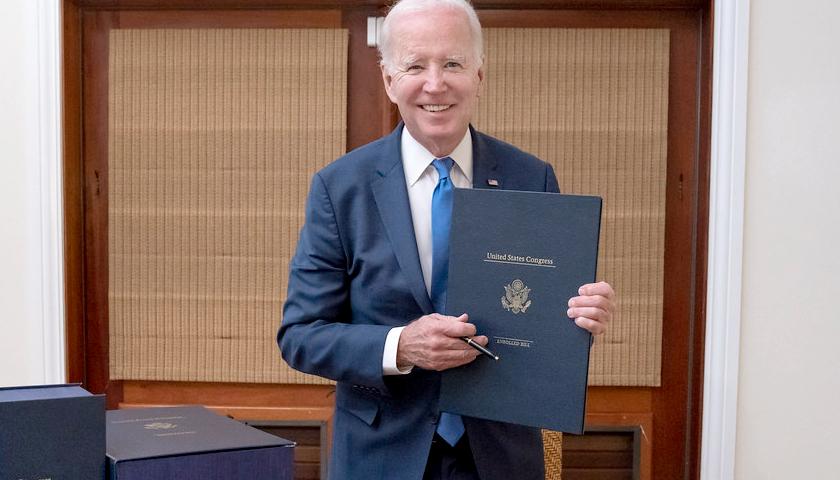

Last week, President Biden said of the IRA, “I’m proud to announce that my, uh, my investments, that through my investments, the most significant climate change law ever. And by the way, it is a $369 billion bill. It’s called the — uh, we, we should have named it what it was.”

Read More